43+ does debt to income ratio include mortgage

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Web Debt to income ratio includes housing plus your other debts and should really be under 36 or so.

Debt To Income Ratio Dti What It Is And How To Calculate It

Get Instantly Matched With Your Ideal Home Loan Lender.

. Web What Your Debt to Income Ratio Means. Ad Check How Much Home Loan You Can Afford. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web Your monthly debt payments would be as follows. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Multiply that by 100 to get a.

Your total monthly debt payments including your credit card payment auto loan mortgage. Compare Loans Calculate Payments - All Online. 36 or less is the healthiest debt load for the majority of people.

Youll usually need a back-end DTI ratio of 43 or less. If your home is highly energy-efficient. Compare Now Find The Lowest Rate.

Compare Loans Calculate Payments - All Online. 800 in monthly housing costs. 43 is getting into the higher interest rate products that can.

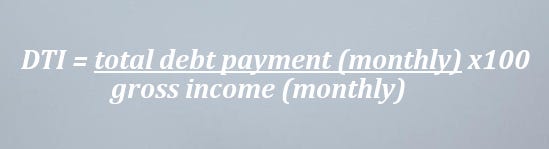

Save Real Money Today. Web 21 hours agoThese trends can include behaviors changes and averages derived from up to 24 months of account history in your credit reports. Web Lenders calculate your debt-to-income ratio by using these steps.

Ad Check How Much Home Loan You Can Afford. Heres how lenders typically view DTI. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Web A 125 monthly personal loan payment.

1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. For example if your monthly pre-tax income. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000 6000 033. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Here are debt-to-income requirements by loan type. Your final result will fall into one of these categories.

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Debt To Income Ratio Requirements And Factors That Influence It

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio For Mortgage Definition And Examples

Most Acceptable Debt To Income Ratio For Mortgage By Biz Infuse Bizinfuse Medium

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Debt To Income Ratio Calculator What Is My Dti Zillow

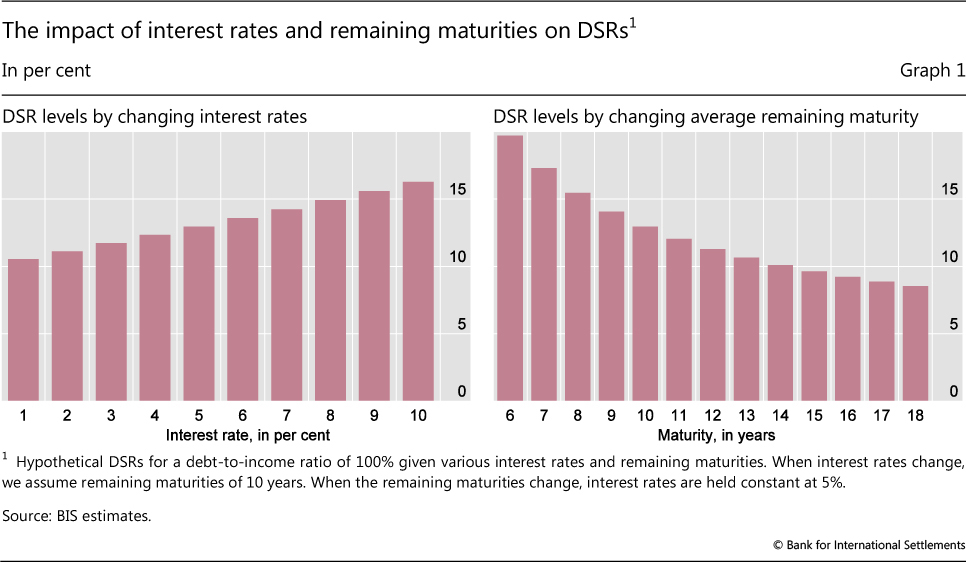

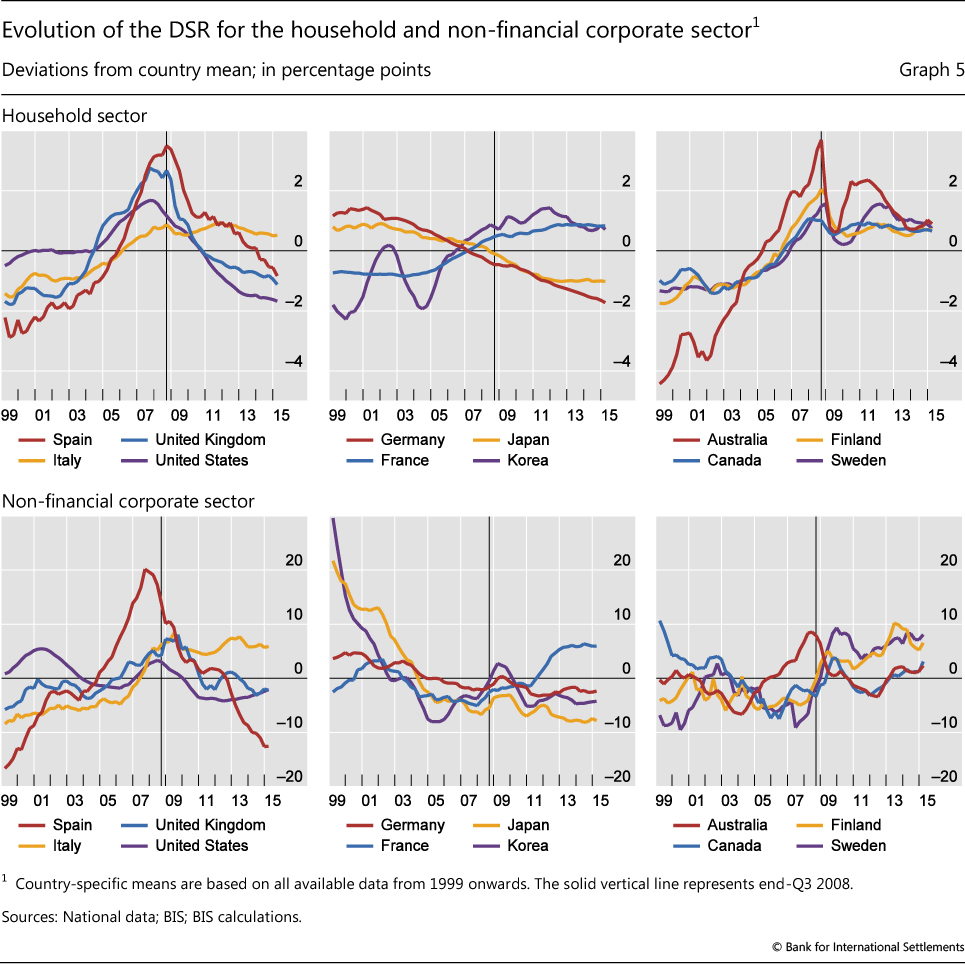

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

Need A Mortgage Keep Debt Levels In Check The New York Times

2023 S Best Home Equity Loans Consumersadvocate Org

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Understanding Dti Debt To Income Ratio Home Loans

Debt To Income Ratio Dti What It Is And How To Calculate It

36 Sample Letter Of Explanation Templates In Pdf Ms Word

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet